11.11.2025

News

Monthly Recap: October 2025

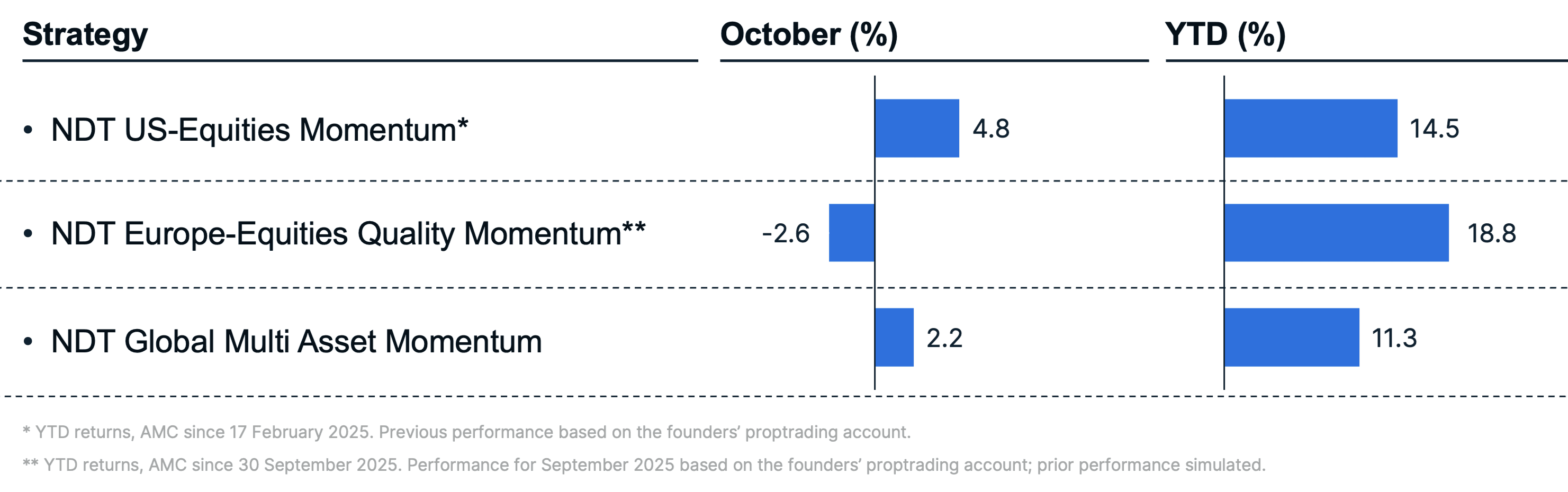

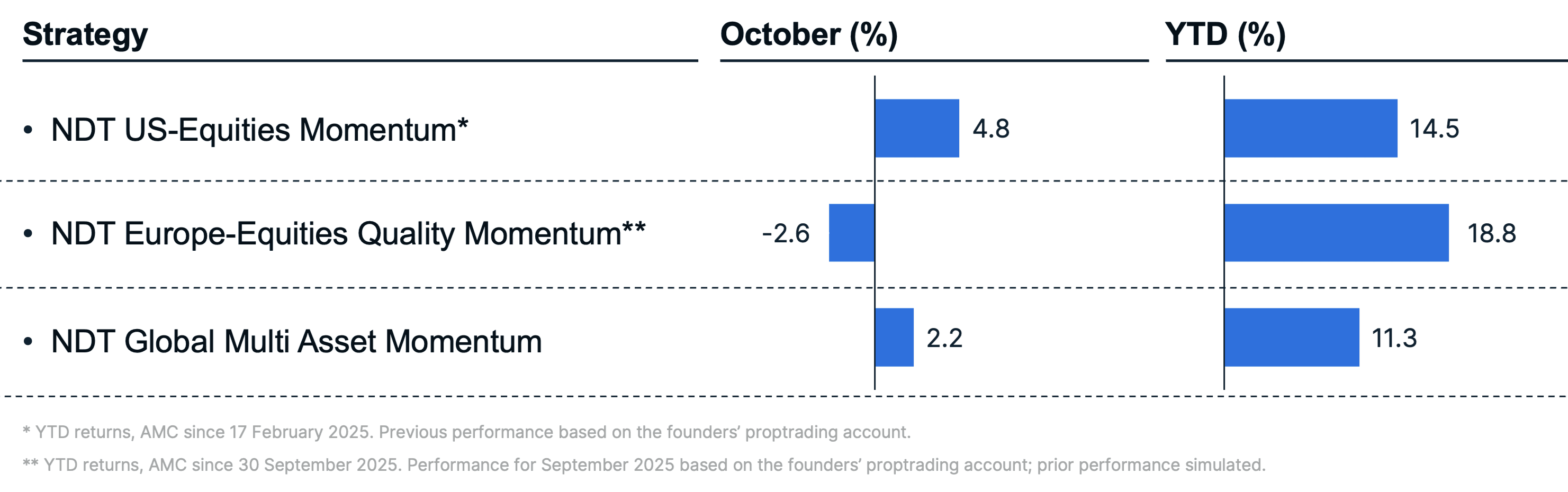

The NDT US-Equities Momentum strategy advanced +4.8%, significantly ahead of its benchmark (which returned +3.6%). The NDT Europe-Equities Quality Momentum strategy declined -2.6%, underperforming its benchmark (+1.5%). The NDT Global Multi Asset Momentum model delivered a return of +2.2%, its benchmark returned +1.6%.

Let us dive into what happened last month:

Market Commentary

US Equities: US large-caps extended their winning streak into the sixth consecutive month, with the S&P 500 rising around +2.3% in October.

Key drivers: Included easing US-China trade tensions, a supportive turn in Fed policy sentiment, and broadly resilient corporate earnings.

US Economic & Policy Backdrop: Inflationary pressures showed signs of moderation, and the macro environment remained supportive for equities. Meanwhile, the 2025 US federal government shutdown (which began in October) added some uncertainty into the data flow and policy domain.

Eurozone & Global: In Europe, economic momentum remained modest: the composite PMI hovered around the 50-mark, industrial activity remained weak in some areas, inflation eased further. The global growth outlook was revised slightly downwards, the International Monetary Fund projects global growth of ~3.1% in 2026.

Rates, Sectors & Themes: With equities advancing, bonds also performed reasonably well, reflecting that early policy and inflation fears were somewhat contained. AI and technology themes continued to be in focus, driving leadership in US markets.

Commodities: Delivered mixed results in October. Precious and industrial metals advanced on supply constraints and renewed investor demand, while oil extended its decline amid ample supply and a stronger USD.

Our Top 3 Performers in the US

Below are the three stocks from our NDT US-Equities Momentum Strategy that posted the strongest gains in October:

Intel Corp (+19.1%)

Intel’s surge in October was driven by earnings beat and renewed investor conviction in its role within AI infrastructure and domestic chip manufacturing. Its strategic foundry partnerships and US government-backed support for semiconductor supply-chains further bolstered sentiment.

Lam Research Corp (+18.9%)

Lam Research capitalized on robust demand for semiconductor-manufacturing equipment, particularly for AI-driven chips, and delivered forward guidance that exceeded market expectations. Investors responded to both record margins and reinforced structural tailwinds in wafer-fabrication equipment, supporting the upward move.

Warner Bros Discovery Inc (+14.9%)

Warner Bros Discovery’s advance was underpinned by streaming-business momentum and strategic actions, including potential asset sales and corporate split plans. Rising subscriber growth and heightened market interest in its future restructuring helped lift investor confidence in the entertainment company.

Our Top 3 Performers in Europe

Here are the three stocks from our NDT Europe-Equities Quality Momentum Strategy that posted the strongest returns in October:

TKMS AG & Co. KGaA (+36.3%)

Following its successful Thyssenkrupp spin-off and strong public market debut, which exceeded analyst valuation expectations. Investor enthusiasm was driven by its position as a leading European provider of non-nuclear submarines and naval technologies, alongside renewed geopolitical focus on maritime defense capabilities.

Auto1 Group SE (+10.0%)

Positioned favorably in the secondary automotive market, AUTO1 saw its shares rise in October, supported by a noticeable uptick in analyst optimism. Investor sentiment was further strengthened by solid forward-growth expectations and improving operational momentum across its platform.

SGS SA (+8.9%)

SGS delivered steady gains supported by resilient global demand for testing, inspection, and certification services. Its broad industrial exposure and strong pricing discipline contributed to consistent performance amid mixed macro conditions.

Main Drags in the Europe-Portfolio during October:

Elisa Oyj (-14.4%)

Elisa declined as competitive pressure in the Finnish mobile market and elevated customer churn weighed on sentiment, despite stable underlying cash-flow generation. Investors grew cautious as margin trends showed slight softening relative to prior periods.

RENK Group AG (-22.4%)

RENK experienced a notable pullback following strong prior gains, with investor sentiment cooling amid broader volatility in defence-related industrials. Visibility remains solid thanks to the backlog and guidance reaffirmation, but the short-term trigger for further upside appears to be absent.

Last Month's Strategy Returns

NDT US-Equities Momentum:

A satellite solution to complement existing portfolios with a concentrated selection of US large-cap stocks with strong momentum.

NDT Europe-Equities Quality Momentum:

Complement your portfolio with a selection of high-momentum and quality stocks out of the STOXX Europe 600.

NDT Global Multi Asset Momentum:

A systematic strategy designed to complement discretionary portfolios for long-term participation in global growth.

For marketing purposes only. Advertising according to Art. 68 FinSA. All rights reserved.

Photo by Oskar Gross: https://www.pexels.com/photo/picturesque-view-of-the-matterhorn-in-zermatt-34192160/

The NDT US-Equities Momentum strategy advanced +4.8%, significantly ahead of its benchmark (which returned +3.6%). The NDT Europe-Equities Quality Momentum strategy declined -2.6%, underperforming its benchmark (+1.5%). The NDT Global Multi Asset Momentum model delivered a return of +2.2%, its benchmark returned +1.6%.

Let us dive into what happened last month:

Market Commentary

US Equities: US large-caps extended their winning streak into the sixth consecutive month, with the S&P 500 rising around +2.3% in October.

Key drivers: Included easing US-China trade tensions, a supportive turn in Fed policy sentiment, and broadly resilient corporate earnings.

US Economic & Policy Backdrop: Inflationary pressures showed signs of moderation, and the macro environment remained supportive for equities. Meanwhile, the 2025 US federal government shutdown (which began in October) added some uncertainty into the data flow and policy domain.

Eurozone & Global: In Europe, economic momentum remained modest: the composite PMI hovered around the 50-mark, industrial activity remained weak in some areas, inflation eased further. The global growth outlook was revised slightly downwards, the International Monetary Fund projects global growth of ~3.1% in 2026.

Rates, Sectors & Themes: With equities advancing, bonds also performed reasonably well, reflecting that early policy and inflation fears were somewhat contained. AI and technology themes continued to be in focus, driving leadership in US markets.

Commodities: Delivered mixed results in October. Precious and industrial metals advanced on supply constraints and renewed investor demand, while oil extended its decline amid ample supply and a stronger USD.

Our Top 3 Performers in the US

Below are the three stocks from our NDT US-Equities Momentum Strategy that posted the strongest gains in October:

Intel Corp (+19.1%)

Intel’s surge in October was driven by earnings beat and renewed investor conviction in its role within AI infrastructure and domestic chip manufacturing. Its strategic foundry partnerships and US government-backed support for semiconductor supply-chains further bolstered sentiment.

Lam Research Corp (+18.9%)

Lam Research capitalized on robust demand for semiconductor-manufacturing equipment, particularly for AI-driven chips, and delivered forward guidance that exceeded market expectations. Investors responded to both record margins and reinforced structural tailwinds in wafer-fabrication equipment, supporting the upward move.

Warner Bros Discovery Inc (+14.9%)

Warner Bros Discovery’s advance was underpinned by streaming-business momentum and strategic actions, including potential asset sales and corporate split plans. Rising subscriber growth and heightened market interest in its future restructuring helped lift investor confidence in the entertainment company.

Our Top 3 Performers in Europe

Here are the three stocks from our NDT Europe-Equities Quality Momentum Strategy that posted the strongest returns in October:

TKMS AG & Co. KGaA (+36.3%)

Following its successful Thyssenkrupp spin-off and strong public market debut, which exceeded analyst valuation expectations. Investor enthusiasm was driven by its position as a leading European provider of non-nuclear submarines and naval technologies, alongside renewed geopolitical focus on maritime defense capabilities.

Auto1 Group SE (+10.0%)

Positioned favorably in the secondary automotive market, AUTO1 saw its shares rise in October, supported by a noticeable uptick in analyst optimism. Investor sentiment was further strengthened by solid forward-growth expectations and improving operational momentum across its platform.

SGS SA (+8.9%)

SGS delivered steady gains supported by resilient global demand for testing, inspection, and certification services. Its broad industrial exposure and strong pricing discipline contributed to consistent performance amid mixed macro conditions.

Main Drags in the Europe-Portfolio during October:

Elisa Oyj (-14.4%)

Elisa declined as competitive pressure in the Finnish mobile market and elevated customer churn weighed on sentiment, despite stable underlying cash-flow generation. Investors grew cautious as margin trends showed slight softening relative to prior periods.

RENK Group AG (-22.4%)

RENK experienced a notable pullback following strong prior gains, with investor sentiment cooling amid broader volatility in defence-related industrials. Visibility remains solid thanks to the backlog and guidance reaffirmation, but the short-term trigger for further upside appears to be absent.

Last Month's Strategy Returns

NDT US-Equities Momentum:

A satellite solution to complement existing portfolios with a concentrated selection of US large-cap stocks with strong momentum.

NDT Europe-Equities Quality Momentum:

Complement your portfolio with a selection of high-momentum and quality stocks out of the STOXX Europe 600.

NDT Global Multi Asset Momentum:

A systematic strategy designed to complement discretionary portfolios for long-term participation in global growth.

For marketing purposes only. Advertising according to Art. 68 FinSA. All rights reserved.

Photo by Oskar Gross: https://www.pexels.com/photo/picturesque-view-of-the-matterhorn-in-zermatt-34192160/