Jan 13, 2026

News

Monthly Recap: December 2025

As we closed out the year and look ahead to 2026, let’s take a moment to revisit how our strategies performed in December.

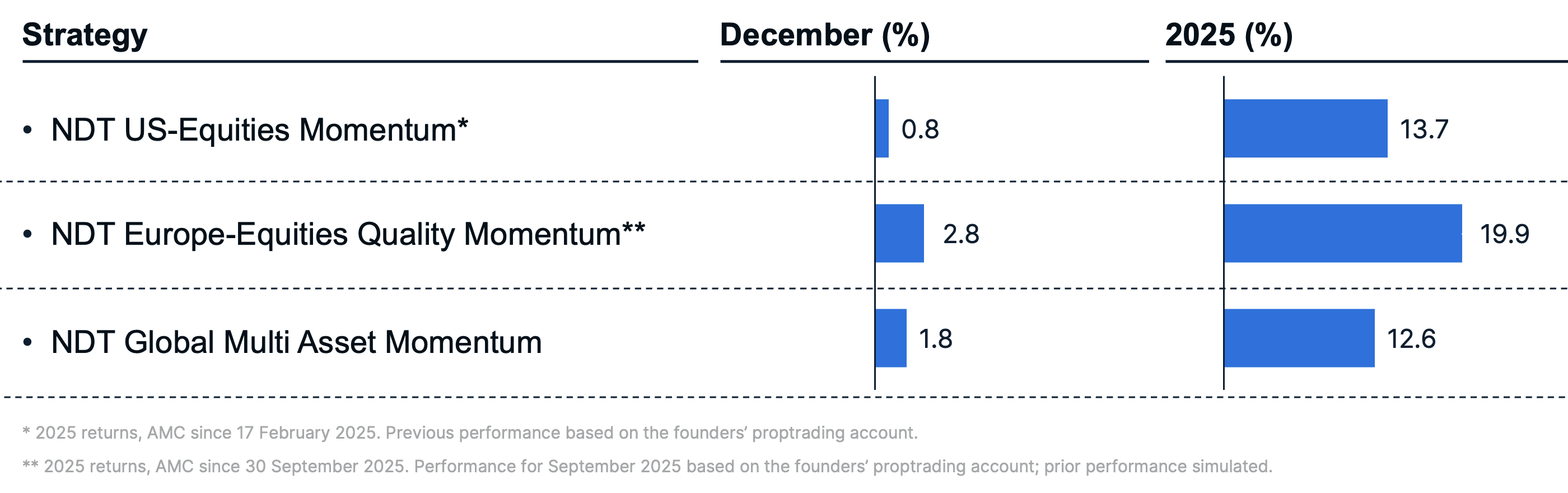

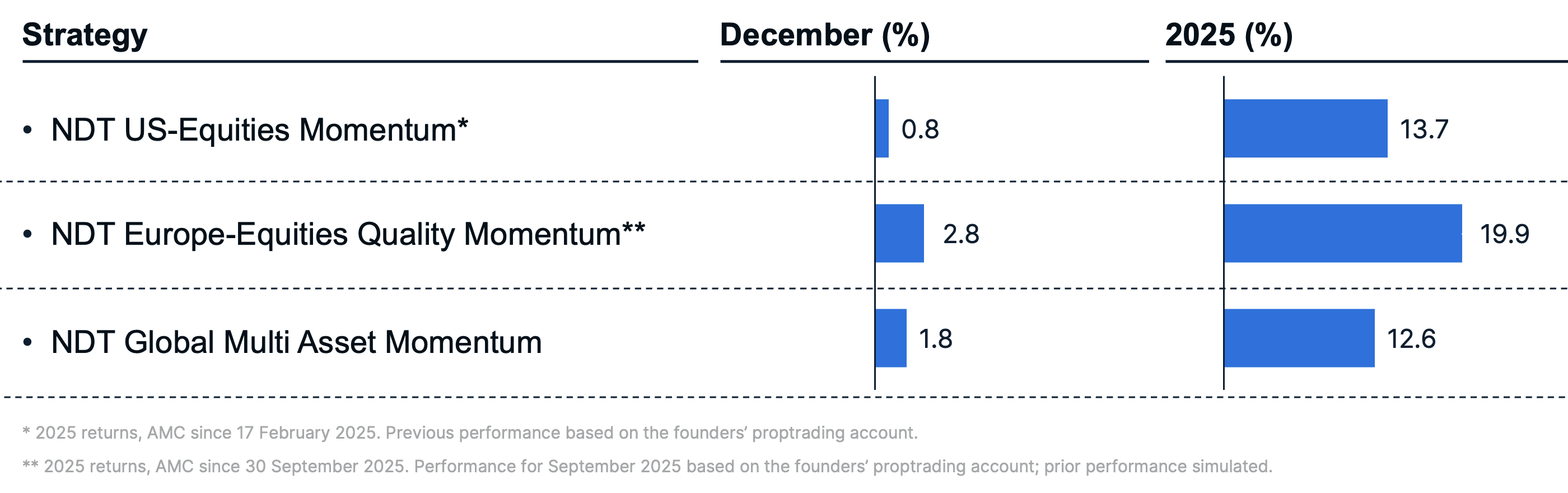

The NDT US-Equities Momentum strategy posted a +0.8% return in December, outperforming its benchmark which returned -0.2%. The NDT Europe-Equities Quality Momentum strategy rose +2.8%, slightly above its benchmark which returned +2.7%. The NDT Global Multi Asset Momentum model returned +1.8%, compared with +0.8% for its benchmark.

Market Commentary

US Equities & Economic Backdrop: US equities traded choppily through December, hitting fresh record levels into the pre-Christmas week before giving back some gains in thin, year-end trading. The month’s overall tone remained “risk-on but selective”, as investors assessed signs of mixed growth signals and a late-month wobble in mega-cap tech amid increased questioning of AI-infrastructure spending.

Key Drivers: Markets continued to balance supportive fundamentals and strong 2025 performance against elevated valuations and policy uncertainty. Investor focus stayed on the Fed path into 2026, while headline risk around tariffs and the sustainability of AI-driven capex (and margins) periodically contributed to sector rotations and volatility.

Eurozone & Global: Globally, the “slow but positive” growth narrative held into year-end, with risk assets supported by easing-rate expectations and improving financial conditions. Europe finished 2025 strongly in local terms, aided by currency moves and a broader shift toward diversification outside the US mega-cap complex.

Rates, Sectors & Themes: Rates were driven by a tug-of-war between easing expectations and fiscal supply concerns, leaving bonds relatively stable into year-end. Equity leadership remained mixed: defensive sectors held up better at times, while parts of mega-cap tech saw profit-taking as investors questioned whether AI build-out costs could pressure margins despite strong demand.

Commodities & Other Assets: Commodities remained uneven, but precious metals continued to stand out as a preferred diversification and hedge theme, a trend that defined 2025. Oil stayed pressured versus earlier in the year amid supply-heavy dynamics, while credit markets remained supported by solid fundamentals and persistent demand for yield into year-end.

Our Top 3 Performers in the US

Below are the three stocks from our NDT US-Equities Momentum Strategy that posted the strongest gains in December:

Micron Technology | +22.7% | Semiconductors & Memory

Micron rallied as investors priced in a structural earnings recovery driven by AI-related demand, tightening high-bandwidth memory supply, and improving profitability. Strong revenue growth and margin expansion reinforced the re-rating of memory as core AI infrastructure into year-end.

Warner Bros Discovery Inc | +21.5% | Media & Entertainment

Warner Bros. Discovery advanced as investors reassessed its earnings outlook following November results showing progress toward near break-even EPS. Shares were further supported by M&A speculation, including the sale of its studio and streaming division to Netflix and a hostile takeover approach from Paramount Skydance; no definitive change of control has been agreed or completed to date.

Lam Research Corp | +10.7% | Semiconductor Equipment

Lam Research gained alongside broader strength in semiconductor equipment, supported by continued AI-driven and advanced-logic capex. Positive sector momentum and favorable year-end sentiment in chip capital-goods names helped extend the rally.

Our Top 3 Performers in Europe

Here are the three stocks from our NDT Europe-Equities Quality Momentum Strategy that posted the strongest returns in December:

Societe General SA | +15.1% | Financials

The share price performed strongly in December, supported by positive momentum in European banking and ongoing capital-return actions. The bank continued executing its EUR 1 billion share buyback programme, repurchasing over 1.2% of its capital and completing more than half of the plan by mid-month, which helped underpin investor confidence.

Airtel Africa PLC | +14.9% | Telecommunications & Mobile Services

Airtel Africa delivered strong share-price performance into year-end, supported by continued execution of its share buyback programme. During December, the company repurchased and cancelled additional shares, reducing its equity base and reinforcing its commitment to capital returns and shareholder value.

Abivax SA | +11.3% | Biotechnology & Pharmaceuticals

Abivax’s shares posted solid gains in December, driven by company-specific catalysts. Key support came from its inclusion in the Nasdaq Biotechnology Index late in the month, alongside renewed takeover speculation and continued progress in its Phase 3 ABTECT trials for obefazimod, its lead treatment for ulcerative colitis.

Last Month's Strategy Returns

NDT US-Equities Momentum:

A satellite solution to complement existing portfolios with a concentrated selection of US large-cap stocks with strong momentum.

NDT Europe-Equities Quality Momentum:

Complement your portfolio with a selection of high-momentum and quality stocks out of the STOXX Europe 600.

NDT Global Multi Asset Momentum:

A systematic strategy designed to complement discretionary portfolios for long-term participation in global growth.

For marketing purposes only. Advertising according to Art. 68 FinSA. All rights reserved.

Photo by Veronika: https://www.pexels.com/photo/snow-covered-evergreen-tree-in-winter-wonderland-35670920/

As we closed out the year and look ahead to 2026, let’s take a moment to revisit how our strategies performed in December.

The NDT US-Equities Momentum strategy posted a +0.8% return in December, outperforming its benchmark which returned -0.2%. The NDT Europe-Equities Quality Momentum strategy rose +2.8%, slightly above its benchmark which returned +2.7%. The NDT Global Multi Asset Momentum model returned +1.8%, compared with +0.8% for its benchmark.

Market Commentary

US Equities & Economic Backdrop: US equities traded choppily through December, hitting fresh record levels into the pre-Christmas week before giving back some gains in thin, year-end trading. The month’s overall tone remained “risk-on but selective”, as investors assessed signs of mixed growth signals and a late-month wobble in mega-cap tech amid increased questioning of AI-infrastructure spending.

Key Drivers: Markets continued to balance supportive fundamentals and strong 2025 performance against elevated valuations and policy uncertainty. Investor focus stayed on the Fed path into 2026, while headline risk around tariffs and the sustainability of AI-driven capex (and margins) periodically contributed to sector rotations and volatility.

Eurozone & Global: Globally, the “slow but positive” growth narrative held into year-end, with risk assets supported by easing-rate expectations and improving financial conditions. Europe finished 2025 strongly in local terms, aided by currency moves and a broader shift toward diversification outside the US mega-cap complex.

Rates, Sectors & Themes: Rates were driven by a tug-of-war between easing expectations and fiscal supply concerns, leaving bonds relatively stable into year-end. Equity leadership remained mixed: defensive sectors held up better at times, while parts of mega-cap tech saw profit-taking as investors questioned whether AI build-out costs could pressure margins despite strong demand.

Commodities & Other Assets: Commodities remained uneven, but precious metals continued to stand out as a preferred diversification and hedge theme, a trend that defined 2025. Oil stayed pressured versus earlier in the year amid supply-heavy dynamics, while credit markets remained supported by solid fundamentals and persistent demand for yield into year-end.

Our Top 3 Performers in the US

Below are the three stocks from our NDT US-Equities Momentum Strategy that posted the strongest gains in December:

Micron Technology | +22.7% | Semiconductors & Memory

Micron rallied as investors priced in a structural earnings recovery driven by AI-related demand, tightening high-bandwidth memory supply, and improving profitability. Strong revenue growth and margin expansion reinforced the re-rating of memory as core AI infrastructure into year-end.

Warner Bros Discovery Inc | +21.5% | Media & Entertainment

Warner Bros. Discovery advanced as investors reassessed its earnings outlook following November results showing progress toward near break-even EPS. Shares were further supported by M&A speculation, including the sale of its studio and streaming division to Netflix and a hostile takeover approach from Paramount Skydance; no definitive change of control has been agreed or completed to date.

Lam Research Corp | +10.7% | Semiconductor Equipment

Lam Research gained alongside broader strength in semiconductor equipment, supported by continued AI-driven and advanced-logic capex. Positive sector momentum and favorable year-end sentiment in chip capital-goods names helped extend the rally.

Our Top 3 Performers in Europe

Here are the three stocks from our NDT Europe-Equities Quality Momentum Strategy that posted the strongest returns in December:

Societe General SA | +15.1% | Financials

The share price performed strongly in December, supported by positive momentum in European banking and ongoing capital-return actions. The bank continued executing its EUR 1 billion share buyback programme, repurchasing over 1.2% of its capital and completing more than half of the plan by mid-month, which helped underpin investor confidence.

Airtel Africa PLC | +14.9% | Telecommunications & Mobile Services

Airtel Africa delivered strong share-price performance into year-end, supported by continued execution of its share buyback programme. During December, the company repurchased and cancelled additional shares, reducing its equity base and reinforcing its commitment to capital returns and shareholder value.

Abivax SA | +11.3% | Biotechnology & Pharmaceuticals

Abivax’s shares posted solid gains in December, driven by company-specific catalysts. Key support came from its inclusion in the Nasdaq Biotechnology Index late in the month, alongside renewed takeover speculation and continued progress in its Phase 3 ABTECT trials for obefazimod, its lead treatment for ulcerative colitis.

Last Month's Strategy Returns

NDT US-Equities Momentum:

A satellite solution to complement existing portfolios with a concentrated selection of US large-cap stocks with strong momentum.

NDT Europe-Equities Quality Momentum:

Complement your portfolio with a selection of high-momentum and quality stocks out of the STOXX Europe 600.

NDT Global Multi Asset Momentum:

A systematic strategy designed to complement discretionary portfolios for long-term participation in global growth.

For marketing purposes only. Advertising according to Art. 68 FinSA. All rights reserved.

Photo by Veronika: https://www.pexels.com/photo/snow-covered-evergreen-tree-in-winter-wonderland-35670920/