Dec 9, 2025

News

Monthly Recap: November 2025

As Christmas draws near, let's take a look back at last month before we ease into the festive holidays.

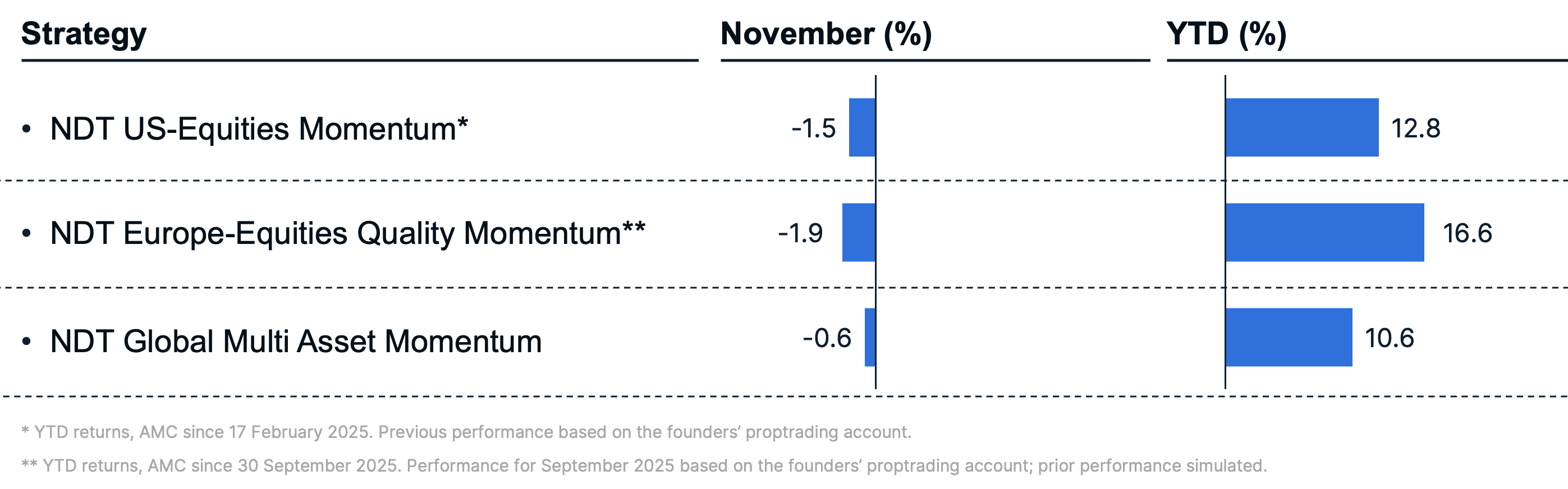

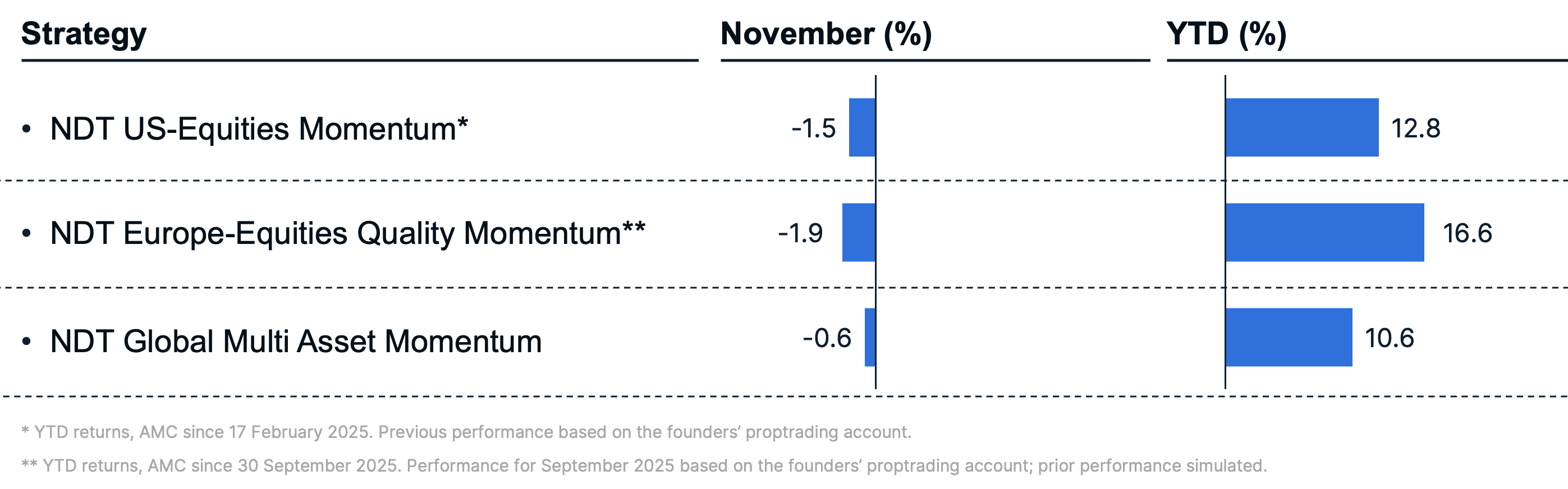

The NDT US-Equities Momentum strategy posted a -1.5% return in November, lagging its benchmark (-0.6%). The NDT Europe-Equities Quality Momentumstrategy declined -1.9%, while its benchmark posted +0.8%. The NDT Global Multi Asset Momentum model returned -0.6%, compared with +0.1% for its benchmark.

Let's dive into what happened last month:

Market Commentary

US Equities & Economic Backdrop: A month with high volatility ended on a positive note, US large caps posted a modest gain in November, with the S&P 500 up around 0.1%. Beneath the surface, returns diverged: profit-taking in prior tech winners contrasted with strength in value, healthcare, regional banks and homebuilders. Economic data continued to signal moderating yet positive growth.

Key Drivers: Markets weighed solid corporate earnings, with a majority of companies beating estimates, against elevated valuations after two strong years. Expectations for additional Fed cuts in early 2026 supported risk sentiment despite intermittent volatility.

Eurozone & Global: The global economy remained in a “slow but positive” phase. Services activity held up, while manufacturing improved gradually. In Europe, easing inflation opened future policy flexibility, though central banks stayed cautious in calling victory on price stability.

Rates, Sectors & Themes: Government bonds steadied after earlier swings as investors balanced prospects of further easing against fiscal-supply concerns. Market leadership broadened: US Healthcare outperformed, while IT lagged amid rotation away from AI-linked names.

Commodities & Other Assets: Commodities were mixed. Precious metals advanced on diversification and macro-hedge demand, while oil recorded a fourth monthly drop on ample supply. Industrial metals reflected shifting global demand. Credit markets remained underpinned by solid fundamentals and expectations of a more accommodative policy backdrop into 2026.

Our Top 3 Performers in the US

Below are the three stocks from our NDT US-Equities Momentum Strategy that posted the strongest gains in November:

Newmont | +12.0% | Precious Metals & Gold Mining

Newmont benefited from firm gold prices and ongoing portfolio optimization after recent acquisitions. Strong cash-flow trends and improved balance-sheet discipline supported sentiment and reinforced its leverage to a resilient precious-metals environment.Broadcom | +8.4% | Semiconductors & Networking Equipment

Broadcom advanced on continued strength in AI-related demand, with investors upbeat on custom accelerators and networking chips. Confidence in software-integration progress and a solid earnings outlook helped sustain positive momentum.Seagate Technology Holdings | +6.9% | Data Storage

Seagate gained as expectations for a storage-cycle recovery improved. Growing demand for high-capacity enterprise drives and AI-driven data-creation trends supported sentiment, while product-mix progress bolstered margin expectations.Our Top 3 Performers in Europe

Our Top 3 Performers in Europe

Here are the three stocks from our NDT Europe-Equities Quality Momentum Strategy that posted the strongest returns in November:

Abivax | +20.9% | Biotechnology & Pharmaceuticals

Abivax rallied on renewed confidence in its late-stage ulcerative-colitis program. Positive data updates and supportive analyst commentary strengthened expectations for the commercial potential of obefazimod (intestinal disease).Zegona Communication | +16.7% | Telecommunications

Zegona rose after outlining major shareholder-return measures and balance-sheet simplification linked to its Spanish telecom assets. The capital-allocation plan improved confidence in value creation and drove strong investor interest.Airtel Africa | +11.7% | Telecommunications

Airtel Africa advanced on solid operational momentum, supported by growth in data and mobile-money usage. Improved currency stability and progress toward future monetization of its fintech arm lifted sentiment.

Main Drags in the Europe-Portfolio during November:

Fincantieri | -23.9% | Shipbuilding & Defense

Fincantieri fell as investors reassessed execution risks across its large naval and cruise-ship backlog. After strong prior gains, profit-taking and caution around project timing weighed on the shares.RENK Group | -22.4% | Defense Equipment & Heavy Engineering

RENK declined amid a broader pullback in defense-exposed industrials. Despite solid backlogs, limited near-term catalysts and profit-taking after strong earlier performance contributed to weaker sentiment.

Last Month's Strategy Returns

NDT US-Equities Momentum:

A satellite solution to complement existing portfolios with a concentrated selection of US large-cap stocks with strong momentum.

NDT Europe-Equities Quality Momentum:

Complement your portfolio with a selection of high-momentum and quality stocks out of the STOXX Europe 600.

NDT Global Multi Asset Momentum:

A systematic strategy designed to complement discretionary portfolios for long-term participation in global growth.

For marketing purposes only. Advertising according to Art. 68 FinSA. All rights reserved.

Photo by Tanathip Rattanatum: https://www.pexels.com/photo/landscape-photo-of-snow-covered-mountains-2026452/

As Christmas draws near, let's take a look back at last month before we ease into the festive holidays.

The NDT US-Equities Momentum strategy posted a -1.5% return in November, lagging its benchmark (-0.6%). The NDT Europe-Equities Quality Momentumstrategy declined -1.9%, while its benchmark posted +0.8%. The NDT Global Multi Asset Momentum model returned -0.6%, compared with +0.1% for its benchmark.

Let's dive into what happened last month:

Market Commentary

US Equities & Economic Backdrop: A month with high volatility ended on a positive note, US large caps posted a modest gain in November, with the S&P 500 up around 0.1%. Beneath the surface, returns diverged: profit-taking in prior tech winners contrasted with strength in value, healthcare, regional banks and homebuilders. Economic data continued to signal moderating yet positive growth.

Key Drivers: Markets weighed solid corporate earnings, with a majority of companies beating estimates, against elevated valuations after two strong years. Expectations for additional Fed cuts in early 2026 supported risk sentiment despite intermittent volatility.

Eurozone & Global: The global economy remained in a “slow but positive” phase. Services activity held up, while manufacturing improved gradually. In Europe, easing inflation opened future policy flexibility, though central banks stayed cautious in calling victory on price stability.

Rates, Sectors & Themes: Government bonds steadied after earlier swings as investors balanced prospects of further easing against fiscal-supply concerns. Market leadership broadened: US Healthcare outperformed, while IT lagged amid rotation away from AI-linked names.

Commodities & Other Assets: Commodities were mixed. Precious metals advanced on diversification and macro-hedge demand, while oil recorded a fourth monthly drop on ample supply. Industrial metals reflected shifting global demand. Credit markets remained underpinned by solid fundamentals and expectations of a more accommodative policy backdrop into 2026.

Our Top 3 Performers in the US

Below are the three stocks from our NDT US-Equities Momentum Strategy that posted the strongest gains in November:

Newmont | +12.0% | Precious Metals & Gold Mining

Newmont benefited from firm gold prices and ongoing portfolio optimization after recent acquisitions. Strong cash-flow trends and improved balance-sheet discipline supported sentiment and reinforced its leverage to a resilient precious-metals environment.Broadcom | +8.4% | Semiconductors & Networking Equipment

Broadcom advanced on continued strength in AI-related demand, with investors upbeat on custom accelerators and networking chips. Confidence in software-integration progress and a solid earnings outlook helped sustain positive momentum.Seagate Technology Holdings | +6.9% | Data Storage

Seagate gained as expectations for a storage-cycle recovery improved. Growing demand for high-capacity enterprise drives and AI-driven data-creation trends supported sentiment, while product-mix progress bolstered margin expectations.Our Top 3 Performers in Europe

Our Top 3 Performers in Europe

Here are the three stocks from our NDT Europe-Equities Quality Momentum Strategy that posted the strongest returns in November:

Abivax | +20.9% | Biotechnology & Pharmaceuticals

Abivax rallied on renewed confidence in its late-stage ulcerative-colitis program. Positive data updates and supportive analyst commentary strengthened expectations for the commercial potential of obefazimod (intestinal disease).Zegona Communication | +16.7% | Telecommunications

Zegona rose after outlining major shareholder-return measures and balance-sheet simplification linked to its Spanish telecom assets. The capital-allocation plan improved confidence in value creation and drove strong investor interest.Airtel Africa | +11.7% | Telecommunications

Airtel Africa advanced on solid operational momentum, supported by growth in data and mobile-money usage. Improved currency stability and progress toward future monetization of its fintech arm lifted sentiment.

Main Drags in the Europe-Portfolio during November:

Fincantieri | -23.9% | Shipbuilding & Defense

Fincantieri fell as investors reassessed execution risks across its large naval and cruise-ship backlog. After strong prior gains, profit-taking and caution around project timing weighed on the shares.RENK Group | -22.4% | Defense Equipment & Heavy Engineering

RENK declined amid a broader pullback in defense-exposed industrials. Despite solid backlogs, limited near-term catalysts and profit-taking after strong earlier performance contributed to weaker sentiment.

Last Month's Strategy Returns

NDT US-Equities Momentum:

A satellite solution to complement existing portfolios with a concentrated selection of US large-cap stocks with strong momentum.

NDT Europe-Equities Quality Momentum:

Complement your portfolio with a selection of high-momentum and quality stocks out of the STOXX Europe 600.

NDT Global Multi Asset Momentum:

A systematic strategy designed to complement discretionary portfolios for long-term participation in global growth.

For marketing purposes only. Advertising according to Art. 68 FinSA. All rights reserved.

Photo by Tanathip Rattanatum: https://www.pexels.com/photo/landscape-photo-of-snow-covered-mountains-2026452/